UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No.__)

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

Amesite Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

AMESITE INC.

607 Shelby Street, Suite 700 PMB 214

Detroit, Michigan 48226

January 23, 2023

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held on February 15, 2023

Dear Stockholder:

We are pleased to invite you to attend the special meeting of stockholders (the “Special Meeting”) of Amesite Inc. (the “Company”), which will be held on February 15, 2023 at 8:45 a.m. Eastern Time.

Due to the continuing public health impact of the coronavirus outbreak (COVID-19) and to support the health and well-being of our employees and stockholders, the Special Meeting will be held in a virtual-only meeting format at www.virtualshareholdermeeting.com/AMST2023SM.

In addition to voting by submitting your proxy prior to the Special Meeting, you also will be able to vote your shares electronically during the Special Meeting. Further details regarding the virtual meeting are included in the accompanying proxy statement. At the Special Meeting, the holders of our outstanding common stock and Series A preferred stock will act on the following matters:

| 1. | To grant discretionary authority to our board of directors to (i) amend our certificate of incorporation to combine outstanding shares of our common stock into a lesser number of outstanding shares, or a “reverse stock split,” at a specific ratio within a range of one-for-five (1-for-5) to a maximum of a one-for-fifty (1-for-50) split, with the exact ratio to be determined by our board of directors in its sole discretion; and (ii) effect the reverse stock split, if at all, within one year of the date the proposal is approved by stockholders; |

| 2. | To approve an amendment the Company’s 2018 Equity Incentive Plan (the “2018 Plan”) to (i) increase the number of shares available for issuance under the 2018 Plan by 3,000,000 shares and (ii) increase the amount of shares that may be issued pursuant to the exercise of incentive stock options by 3,000,000 shares; and |

| 3. | To transact such other matters as may properly come before the Special Meeting and any adjournment or postponement thereof. |

Our board of directors has fixed January 20, 2023 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Special Meeting and at any adjournment or postponement of the meeting.

IF YOU PLAN TO ATTEND:

To be admitted to the Special Meeting, which is being held virtually, you must have your control number available and follow the instructions found on your proxy card or voting instruction form. You may vote during the Special Meeting by following the instructions available on the meeting website during the meeting. Please allow sufficient time before the Special Meeting to complete the online check-in process. Your vote is very important.

If you have any questions or need assistance voting your shares, please call our proxy solicitor, Kingsdale Advisors:

Strategic Stockholder Advisor and Proxy Solicitation Agent

745 Fifth Avenue, 5th Floor, New York, New York 10151

North American Toll-Free Phone:

1-866-229-8874

Email: contactus@kingsdaleadvisors.com

Call Collect Outside North America: +1 (917) 813-1246

| BY ORDER OF THE BOARD OF DIRECTORS | |

| January 23, 2023 | /s/ Ann Marie Sastry, Ph.D. |

|

Ann Marie Sastry, Ph.D. Chairman of the Board of Directors |

Whether or not you expect to attend the virtual Special Meeting, we urge you to vote your shares at your earliest convenience. This will ensure the presence of a quorum at the Special Meeting. Promptly voting your shares will save the Company the expenses and extra work of additional solicitation. An addressed envelope for which no postage is required if mailed in the United States is enclosed if you wish to vote by mail. Submitting your proxy now will not prevent you from voting your shares at the Special Meeting if you desire to do so, as your proxy is revocable at your option. Your vote is important, so please act today!

AMESITE INC.

607 Shelby Street, Suite 700PMB 214

Detroit, Michigan 48226

PROXY STATEMENT FOR THE

SPECIAL MEETING OF STOCKHOLDERS

To be held on February 15, 2023

The board of directors of Amesite Inc. (“Amesite” or the “Company”) is soliciting your proxy to vote at the Special Meeting of Stockholders (the “Special Meeting”) to be held on February 15, 2023, at 8:45 a.m. Eastern Time, in a virtual format online by accessing www.virtualshareholdermeeting.com/AMST2023SM, and at any adjournment thereof.

This proxy statement contains information relating to the Special Meeting. This Special Meeting of stockholders will be held as a virtual meeting. Stockholders attending the virtual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting. You will be able to attend and participate in the Special Meeting online via a live webcast by visiting www.virtualshareholdermeeting.com/AMST2023SM. In addition to voting by submitting your proxy prior to the Special Meeting, you also will be able to vote your shares electronically during the Special Meeting.

We intend to begin mailing the attached notice of the Special Meeting and the enclosed proxy card on or about January 25, 2023 to all stockholders of record entitled to vote at the Special Meeting. Only stockholders who owned our common stock or Series A preferred stock on January 20, 2023 are entitled to vote at the Special Meeting.

AMESITE INC.

TABLE OF CONTENTS

i

GENERAL INFORMATION ABOUT THIS PROXY STATEMENT AND VOTING

What is a proxy?

A proxy is the legal designation of another person to vote the stock you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document is also called a proxy or a proxy card. By completing, signing and returning the accompanying proxy card, you are designating Ann Marie Sastry, Ph.D., Chief Executive Officer of the Company, and Sherlyn W. Farrell, Chief Financial Officer of the Company, as your proxies for the Special Meeting and you are authorizing such proxies to vote your shares at the Special Meeting as you have instructed on the proxy card. This way, your shares will be voted whether or not you attend the Special Meeting. Even if you plan to attend the Special Meeting, we urge you to vote in one of the ways described below so that your vote will be counted even if you are unable or decide not to attend the Special Meeting.

What is a proxy statement?

A proxy statement is a document that we are required by the regulations of the United States Securities and Exchange Commission (the “SEC”) to give you when we ask you to sign a proxy card designating Ann Marie Sastry, Ph.D. and Sherlyn W. Farrell as proxies to vote on your behalf.

Why did you send me this proxy statement?

We sent you this proxy statement and the enclosed proxy card because our board of directors is soliciting your proxy to vote at the Special Meeting. This proxy statement summarizes information related to your vote at the Special Meeting. All stockholders who find it convenient to do so are cordially invited to attend the Special Meeting virtually. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, sign and return the enclosed proxy card or vote over the Internet or by phone.

We intend to begin mailing the attached notice of Special Meeting and the enclosed proxy card on or about January 25, 2023 to all stockholders of record entitled to vote at the Special Meeting. Only stockholders who owned our common stock and Series A preferred stock on January 20, 2023 are entitled to vote at the Special Meeting.

What does it mean if I receive more than one set of proxy materials?

If you receive more than one set of proxy materials, your shares may be registered in more than one name or in different accounts. Please complete, sign, and return each proxy card to ensure that all of your shares are voted.

How do I attend the Special Meeting?

The Special Meeting will be held on February 15, 2023, at 8:45 a.m. Eastern Time in a virtual format online by accessing www.virtualshareholdermeeting.com/AMST2023SM. Information on how to vote in person at the Special Meeting is discussed below.

Who is entitled to vote?

The board of directors has fixed the close of business on January 20, 2023 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Special Meeting or any adjournment or postponement thereof. On the Record Date, there were 30,344,305 shares of common stock and 100,000 shares of Series A preferred stock issued and outstanding. Each share of common stock represents one vote that may be voted on each proposal that may come before the Special Meeting. Each share of Series A preferred stock represents 1,000 votes that may be voted solely on the Reverse Stock split proposal (“Proposal 1”), provided that such votes must be counted in the same proportion as the shares of common stock voted on Proposal 1. As an example, if 50.5% of the shares of common stock are voted FOR Proposal 1, 50.5% of the votes cast by the holder of the Series A preferred stock will be cast as votes FOR Proposal 1. Holders of common stock and Series A preferred stock will vote on Proposal 1 as a single class.

- 1 -

What is the difference between holding shares as a record holder and as a beneficial owner (holding shares in street name)?

If your shares are registered in your name with our transfer agent, Continental Stock Transfer & Trust Company, you are the “record holder” of those shares. If you are a record holder, these proxy materials have been provided directly to you by the Company.

If your shares are held in a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner” of those shares held in “street name”. If your shares are held in street name, these proxy materials have been forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Special Meeting. As the beneficial owner, you have the right to instruct this organization on how to vote your shares. See “How Will my Shares be Voted if I Give No Specific Instruction?” below for information on how shares held in street name will be voted without instructions provided.

Who may attend the Special Meeting?

Only record holders and beneficial owners of our common stock and Series A preferred stock, or their duly authorized proxies, may attend the Special Meeting. If your shares are held in street name, you will need to provide a copy of a brokerage statement or other documentation reflecting your stock ownership as of the Record Date.

What am I voting on?

There are two matters scheduled for a vote:

| 1. | To grant discretionary authority to our board of directors to (i) amend our certificate of incorporation to combine outstanding shares of our common stock into a lesser number of outstanding shares, or a “reverse stock split,” at a specific ratio within a range of one-for-five (1-for-5) to a maximum of a one-for-fifty (1-for-50) split, with the exact ratio to be determined by our board of directors in its sole discretion; and (ii) effect the reverse stock split, if at all, within one year of the date the proposal is approved by stockholders; |

| 2. | To approve an amendment the Company’s 2018 Equity Incentive Plan (the “2018 Plan”) to (i) increase the number of shares available for issuance under the 2018 Plan by 3,000,000 shares and (ii) increase the amount of shares that may be issued pursuant to the exercise of incentive stock options by 3,000,000 shares; |

What if another matter is properly brought before the Special Meeting?

The board of directors knows of no other matters that will be presented for consideration at the Special Meeting. If any other matters are properly brought before the Special Meeting, it is the intention of the person named in the accompanying proxy to vote on those matters in accordance with his best judgment.

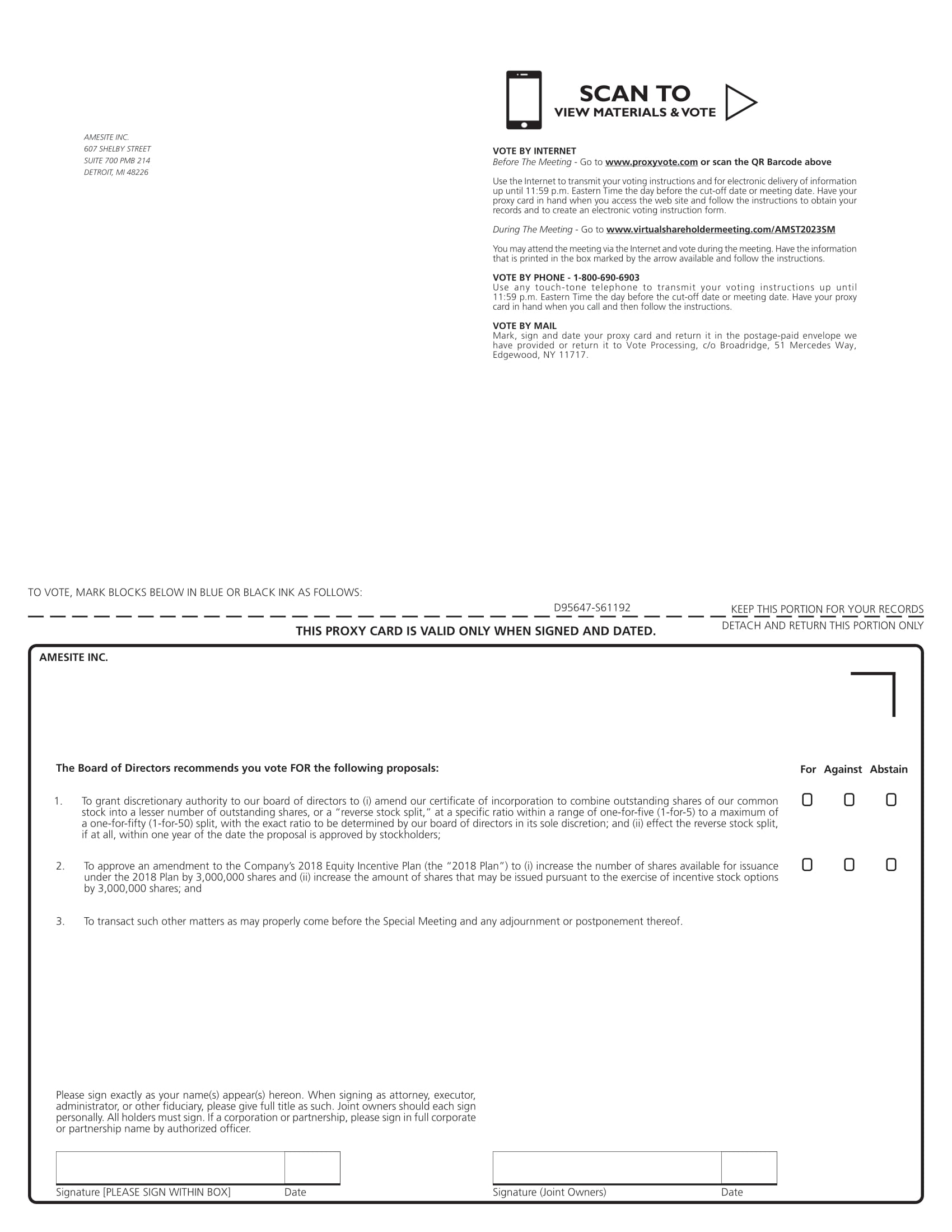

How do I vote?

| INTERNET | PHONE | ONLINE AT THE MEETING | ||||

| Mailing your signed proxy card or voter instruction card. | Using the Internet before the Meeting at: | By calling: | You can vote during the Meeting at: | |||

| www.proxyvote.com | 1-800-690-6903 | www.virtualshareholdermeeting.com/AMST2023SM |

Stockholders of Record

If you are a registered stockholder, you may vote by mail, phone or online at the Special Meeting by following the instructions above. You also may submit your proxy by mail by following the instructions included with your proxy card. The deadline for submitting your proxy by Internet is 11:59 p.m. Eastern Time on February 14, 2023. Our board of directors’ designated proxies, Ann Marie Sastry, Ph.D. and Sherlyn W. Farrell, will vote your shares according to your instructions. If you attend the live webcast of the Special Meeting, you also will be able to vote your shares electronically at the Special Meeting up until the time the polls are closed.

- 2 -

Beneficial Owners of Shares Held in Street Name

If you are a street name holder, your broker or nominee firm is the legal, registered owner of the shares, and it may provide you with materials in connection with the Special Meeting. Follow the instructions on the materials you receive to access our proxy materials and vote or to request a paper or email copy of our proxy materials. The materials include a voting instruction card so that you can instruct your broker or nominee how to vote your shares. Please check the voting instruction card or contact your broker or other nominee to determine whether you will be able to deliver your voting instructions by Internet in advance of the meeting and whether, or if you attend the live webcast of the Special Meeting, if you will be able to vote your shares electronically at the meeting up until the time the polls are closed.

All shares entitled to vote and represented by a properly completed and executed proxy received before the Special Meeting and not revoked will be voted at the Special Meeting as instructed in a proxy delivered before the Special Meeting. We provide Internet proxy voting to allow you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone companies.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of the close of business on the Record Date. Each share of Series A preferred stock that you own as of the close of business on the Record Date entitles you to 1,000 votes, which is referred to as supermajority voting; however, the votes by the holders of Series A preferred stock will be counted in the same “mirrored” proportion as the aggregate votes cast by the holders of common stock and Series A preferred stock who vote on this proposal.

Is my vote confidential?

Yes, your vote is confidential. Only the inspector of elections, individuals who help with processing and counting your votes and persons who need access for legal reasons will have access to your vote. This information will not be disclosed, except as required by law.

What constitutes a quorum?

To carry on business at the Special Meeting, we must have a quorum. A quorum is present when a majority of the shares entitled to vote, as of the Record Date, are represented in person or by proxy. Thus, the holders of a majority of the voting power of the 30,344,305 shares of common stock and 100,000 shares of Series A preferred stock must be represented in person or by proxy to have a quorum at the Special Meeting. Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote in person at the Special Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. Shares owned by the Company are not considered outstanding or considered to be present at the Special Meeting. If there is not a quorum at the Special Meeting, either the chairperson of the Special Meeting or our stockholders entitled to vote at the Special Meeting may adjourn the Special Meeting to a future date as allowed under applicable law.

How will my shares be voted if I give no specific instruction?

We must vote your shares as you have instructed. If there is a matter on which a stockholder of record has given no specific instruction but has authorized us generally to vote the shares, they will be voted as follows:

| 1. | “For” the grant of discretionary authority to our board of directors to (i) amend our certificate of incorporation to combine outstanding shares of our common stock into a lesser number of outstanding shares, or a “reverse stock split,” at a specific ratio within a range of one-for-five (1-for-5) to a maximum of a one-for-fifty (1-for-50) split, with the exact ratio to be determined by our board of directors in its sole discretion; and (ii) effect the reverse stock split, if at all, within one year of the date the proposal is approved by stockholders; |

- 3 -

| 2. | “For” the approval and adoption of an amendment the Company’s 2018 Equity Incentive Plan (the “2018 Plan”) to (i) increase the number of shares available for issuance under the 2018 Plan by 3,000,000 shares and (ii) increase the amount of shares that may be issued pursuant to the exercise of incentive stock options by 3,000,000 shares; |

This authorization would exist, for example, if a stockholder of record merely signs, dates and returns the proxy card but does not indicate how such shares are to be voted on one or more proposals. If other matters properly come before the Special Meeting and you do not provide specific voting instructions, your shares will be voted at the discretion of Ann Marie Sastry, Ph.D. and Sherlyn W. Farrell, the board of directors’ designated proxies.

If your shares are held in street name, see “What is a broker non-vote?” below regarding the ability of banks, brokers and other such holders of record to vote the uninstructed shares of their customers or other beneficial owners in their discretion.

How are votes counted?

Votes will be counted by the inspector of election appointed for the Special Meeting who will count votes “For” and “Against,” abstentions and broker non-votes. Broker non-votes will not be included in the tabulation of the voting results of any of the proposals and, therefore, will have no effect on such proposals.

What is a broker non-vote?

A “broker non-vote” occurs when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a proposal because (1) the broker has not received voting instructions from the stockholder who beneficially owns the shares and (2) the broker lacks the authority to vote the shares at their discretion.

Our common stock is listed on The Nasdaq Capital Market. However, under current New York Stock Exchange (“NYSE”) rules and interpretations that govern broker non-votes: (i) Proposal No. 1 for the grant of authority to the board of directors concerning the reverse stock split is considered a discretionary matter, and a broker will be permitted to exercise its discretion to vote uninstructed shares on the proposal; and (ii) Proposal No. 2 for the adoption of the amendment to the 2018 Plan, is considered a non-discretionary matter, and a broker will not be permitted to exercise its discretion to vote uninstructed shares on the proposal. Because NYSE rules apply to all brokers that are members of the NYSE, this prohibition applies to the Special Meeting even though our common stock is listed on The Nasdaq Capital Market.

What is an abstention?

An abstention is a stockholder’s affirmative choice to decline to vote on a proposal. Under Delaware law, abstentions are counted as shares present and entitled to vote at the Special Meeting. Generally, unless provided otherwise by applicable law, our Bylaws (“Bylaws”) provide that an action of our stockholders (other than for the election of directors) is approved if a majority of the number of shares of stock entitled to vote thereon and present (either in person or by proxy) vote in favor of such action.

- 4 -

How many votes are required to approve each proposal?

The table below summarizes the proposals that will be voted on, the vote required to approve each item, and how votes are counted:

| Proposal | Votes Required | Voting Options | Impact of “Withhold” or “Abstain” Votes |

Broker Discretionary Voting Allowed | ||||

| Proposal No. 1: Reverse Stock Split | The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively (excluding abstentions and broker non-votes) at the Special Meeting by the holders entitled to vote thereon. | “FOR” “AGAINST” “ABSTAIN” | None(1) | Yes(2) | ||||

| Proposal No. 2: Adoption of the Amendment to the Plan | The affirmative vote of the holders of a majority in voting power of the votes cast affirmatively or negatively (excluding abstentions) at the Special Meeting by the holders entitled to vote thereon. | “FOR” “AGAINST” “ABSTAIN” | None(1) | No(3) |

| (1) | A vote marked as an “Abstention” is not considered a vote cast and will, therefore, not affect the outcome of this proposal. |

| (2) | As this proposal is considered a discretionary matter, brokers are permitted to exercise their discretion to vote uninstructed shares on this proposal. |

| (3) | As this proposal is not considered a discretionary matter, brokers lack authority to exercise their discretion to vote uninstructed shares on this proposal. |

What are the voting procedures?

In voting by proxy with regard to the election of directors, you may vote in favor of all nominees, withhold your votes as to all nominees, or withhold your votes as to specific nominees. With regard to other proposals, you may vote in favor of or against the proposal, or you may abstain from voting on the proposal. You should specify your respective choices on the accompanying proxy card or your vote instruction form.

Is my proxy revocable?

You may revoke your proxy and reclaim your right to vote at any time before your proxy is voted by giving written notice to the Secretary of the Company by delivering a properly completed, later-dated proxy card or vote instruction form or by voting in person at the Special Meeting. All written notices of revocation and other communications with respect to revocations of proxies should be addressed to: Amesite Inc., 607 Shelby Street, Suite 700 PMB 214, Detroit, Michigan 48226, Attention: Secretary. Your most current proxy card or Internet proxy is the one that will be counted.

Who is paying for the expenses involved in preparing and mailing this proxy statement?

All of the expenses involved in preparing, assembling and mailing these proxy materials and all costs of soliciting proxies will be paid by us. In addition to the solicitation by mail, proxies may be solicited by our officers and other employees by telephone or in person. Such persons will receive no compensation for their services other than their regular salaries. Arrangements will also be made with brokerage houses and other custodians, nominees and fiduciaries to forward solicitation materials to the beneficial owners of the shares held of record by such persons, and we may reimburse such persons for reasonable out of pocket expenses incurred by them in forwarding solicitation materials. We have retained Kingsdale Advisors as our strategic stockholder advisor and proxy solicitation agent in connection with the solicitation of proxies for the Special Meeting. If you have any questions or require any assistance with completing your proxy, please contact Kingsdale Advisors by telephone (toll-free within North America) at +1 (866) 581-1489 or (call collect outside North America) at +1 (416) 867-2272 or by email at contactus@kingsdaleadvisors.com.

Do I have dissenters’ rights of appraisal?

Stockholders do not have appraisal rights under Delaware law or under Amesite’s governing documents with respect to the matters to be voted upon at the Special Meeting.

How can I find out the results of the voting at the Special Meeting?

Preliminary voting results will be announced at the Special Meeting. In addition, final voting results will be disclosed in a Current Report on Form 8-K that we expect to file with the SEC within four business days after the Special Meeting. If final voting results are not available to us in time to file a Form 8-K with the SEC within four business days after the Special Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an amended Form 8-K to publish the final results.

- 5 -

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information regarding beneficial ownership of shares of our common stock as of January 20, 2023 based on 30,344,305 shares of common stock and 100,000 shares of Series A preferred stock issued and outstanding by (i) each person known to beneficially own more than 5% of our outstanding common stock, (ii) each of our directors and director nominees, (iii) our named executive officers and (iv) all directors and executive officers as a group. Shares are beneficially owned when an individual has voting and/or investment power over the shares or could obtain voting and/or investment power over the shares within 60 days of the Record Date. Except as otherwise indicated, the persons named in the table have sole voting and investment power with respect to all shares beneficially owned, subject to community property laws, where applicable. Unless otherwise indicated, the address of each beneficial owner listed below is c/o Amesite Inc., 607 Shelby Street, Suite 700 PMB 214, Detroit, Michigan 48226.

The percentage of total voting power information is based on 30,344,305 shares of common stock and 100,000 shares of our Series A preferred stock outstanding as of the Record Date. We have determined beneficial ownership in accordance with the rules of the SEC. These rules generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power with respect to those securities. In addition, the rules attribute beneficial ownership of securities as of a particular date to persons who hold options or warrants to purchase shares of common stock and that are exercisable within 60 days of such date. These shares are deemed to be outstanding and beneficially owned by the person holding those options or warrants for the purpose of computing the percentage ownership of that person, but they are not treated as outstanding for the purpose of computing the percentage ownership of any other person. Unless otherwise indicated, the persons or entities identified in this table have sole voting and investment power with respect to all shares shown as beneficially owned by them, subject to applicable community property laws.

| Name of Beneficial Owner and Title of | Shares of Common Stock Beneficially Owned | Shares of Series A Preferred Stock Beneficially Owned | % of Total Voting | |||||||||||||||||

| Officers and Directors | Shares | % | Shares | % | Power | |||||||||||||||

| Ann Marie Sastry, Ph.D., President, Chief Executive Officer, and Chairman of the Board (1) | 6,806,667 | 22.1 | % | |||||||||||||||||

| Sherlyn W. Farrell, Chief Financial Officer | * | * | ||||||||||||||||||

| J. Michael Losh, Director (2) | 451,041 | 1.5 | % | |||||||||||||||||

| Gilbert S. Omenn, M.D., Ph.D., Director (3) | 258,124 | * | % | |||||||||||||||||

| Richard T. Ogawa, Director (4) | 692,707 | 2.2 | % | |||||||||||||||||

| Anthony M. Barkett, Director (5) | 377,917 | 1.2 | % | |||||||||||||||||

| Barbie Brewer, Director (6) | 325,000 | 1.1 | % | |||||||||||||||||

| George Parmer, Director (7) | 1,009,999 | 3.3 | % | 100,000 | 100 | % | 77.5 | % | ||||||||||||

| All Officers and Directors as a Group (8 persons) (8) | 9,921,455 | 32.3 | % | 100,000 | 100 | % | 82.8 | % | ||||||||||||

| Beneficial Owner Greater than 5% Stockholders | * | |||||||||||||||||||

| Mark Tompkins (9) | 2,043,103 | 6.7 | % | |||||||||||||||||

| * | Less than 1%. |

| (1) | Includes (i) 6,281,667 shares of common stock held by Dr. Sastry and (ii) 525,000 shares of common stock underlying options that are presently exercisable or exercisable within 60 days of the Record Date held by Dr. Sastry. |

| (2) | Includes (i) 41,666 shares of common stock held by Mr. Losh and (ii) 409,375 shares of common stock underlying options that are presently exercisable or exercisable within 60 days of the Record Date held by Mr. Losh. |

| (3) | Includes (i) 41,666 shares of common stock held by Dr. Omenn and (ii) 216,458 shares of common stock underlying options that are presently exercisable or exercisable within 60 days of the Record Date held by Dr. Omenn. |

| (4) | Includes (i) 66,666 shares of common stock held by Mr. Ogawa and (ii) 626,041 shares of common stock underlying options that are presently exercisable or exercisable within 60 days of the Record Date held by Mr. Ogawa. |

| (5) | Includes (i) 50,000 shares of common stock held by Mr. Barkett and (ii) 327,917 shares of common stock underlying options that are presently exercisable or exercisable within 60 days of the Record Date held by Mr. Barkett. |

| (6) | Includes (i) 25,000 shares of common stock held by Ms. Brewer and (ii) 300,000 shares of common stock underlying options that are presently exercisable or exercisable within 60 days of the Record Date held by Ms. Brewer. |

| (7) | Includes (i) 1,009,999 shares of common stock held by Mr. Parmer and (ii) 100,000 shares of Series A Preferred Stock held by Mr. Parmer. |

| (8) | Includes 2,404,791 shares of common stock underlying options that are either presently exercisable or exercisable within 60 days of the Record Date held by all directors and officers as a group. |

| (9) | Mr. Tompkins’s address is Apt 1, via Guidino 23, 6900 Lugano, Paradiso, Switzerland. Mr. Tompkins has voting and dispositive authority over the shares. |

- 6 -

CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

The following is a description of transactions since July 1, 2020 to which the Company party, in which the amount involved exceeds the lesser of $120,000 or one percent of the average of the Company’s total assets at year-end for the last two completed fiscal years, and in which any of our respective directors, director nominees, executive officers or beneficial owners of more than 5% of our capital stock, or an affiliate or immediate family member thereof, had or will have a direct or indirect material interest.

Related Party Advances

Since November 2017, Dr. Sastry has advanced approximately $239,292 to us to fund our start-up operations, which included research and development, organizational costs, and various professional fees in connection with the private placement offerings and insider investment. We did not have a formal arrangement or agreement with Dr. Sastry pursuant to which these funds were paid. Dr. Sastry paid certain related expenses and was reimbursed out of proceeds of private placement financings. Dr. Sastry was repaid without interest.

Indemnification Agreements and Directors’ and Officers’ Liability Insurance

We will enter into indemnification agreements with each of our directors and executive officers. These agreements, among other things, will require us to indemnify each director and executive officer to the fullest extent permitted by Delaware law, including indemnification of expenses such as attorneys’ fees, judgments, fines and settlement amounts incurred by the director or executive officer in any action or proceeding, including any action or proceeding by or in right of us, arising out of the person’s services as a director or executive officer.

Consulting Agreements

On March 29, 2018, Amesite Parent’s board of directors approved a consulting agreement with Mr. Richard Ogawa whereby Mr. Ogawa provided certain consulting services to us relating to the protection of our intellectual property and general business advice for our benefit. We agreed to pay Mr. Ogawa $1,000 for each filed patent application and $1,000 for each issued or granted patent regardless of the jurisdiction or type of patent, except for provisional patent applications for which no fee would be paid by us. In addition, we granted Mr. Ogawa a nonqualified stock option to purchase 291,666 shares of Amesite Parent’s common stock at an exercise price of $1.50 per share (subject to adjustment for the Merger).

Private Placement of Series A Preferred Stock

On January 13, 2023, we entered into a Subscription and Investment Representation Agreement (the “Subscription Agreement”) with George Parmer, a member of our Board of Directors, who is an accredited investor (the “Purchaser”), pursuant to which the Company agreed to issue and sell 100,000 shares of the Company’s Series A preferred stock for $1,000. Each share of Series A preferred stock entitles the holder to 1,000 votes and will vote together with the outstanding shares of the Company’s common stock as a single class exclusively with respect to any proposal to amend the Company’s Certificate of Incorporation to effect a reverse stock split of the Company’s common stock. The Series A preferred stock will be voted, without action by the holder, on any such proposal in the same proportion as shares of common stock are voted. The Series A preferred stock otherwise has no voting rights except as otherwise required by the General Corporation Law of the State of Delaware. The Series A preferred stock is not convertible into, or exchangeable for, shares of any other class or series of stock or other securities of the Company. The Series A preferred stock has no rights with respect to any distribution of assets of the Company, including upon a liquidation, bankruptcy, reorganization, merger, acquisition, sale, dissolution or winding up of the Company, whether voluntarily or involuntarily. The holder of the Series A preferred stock will not be entitled to receive dividends of any kind. The outstanding shares of Series A preferred stock shall be redeemed in whole, but not in part, at any time (i) if such redemption is ordered by the Board of Directors in its sole discretion or (ii) automatically upon the effectiveness of the amendment to the Certificate of Incorporation implementing a reverse stock split. Upon such redemption, the holder of the Series A preferred stock will receive consideration of $1,000.

- 7 -

Related Person Transaction Policy

We have not had a formal policy regarding approval of transactions with related parties. We expect to adopt a related person transaction policy that sets forth our procedures for the identification, review, consideration and approval or ratification of related person transactions. For purposes of our policy only, a related person transaction is a transaction, arrangement or relationship, or any series of similar transactions, arrangements or relationships, in which we and any related person are, were or will be participants in which the amount involved exceeds the lesser of $120,000 or one percent of our total assets at year-end for our last two completed fiscal years. Transactions involving compensation for services provided to us as an employee or director are not covered by this policy. A related person is any executive officer, director or beneficial owner of more than 5% of any class of our voting securities, including any of their immediate family members and any entity owned or controlled by such persons.

Under the policy, if a transaction has been identified as a related person transaction, including any transaction that was not a related person transaction when originally consummated or any transaction that was not initially identified as a related person transaction prior to consummation, our management must present information regarding the related person transaction to our audit committee, or, if audit committee approval would be inappropriate, to another independent body of our board of directors, for review, consideration and approval or ratification. The presentation must include a description of, among other things, the material facts, the interests, direct and indirect, of the related persons, the benefits to us of the transaction and whether the transaction is on terms that are comparable to the terms available to or from, as the case may be, an unrelated third party or to or from employees generally. Under the policy, we will collect information that we deem reasonably necessary from each director, executive officer and, to the extent feasible, significant shareholder to enable us to identify any existing or potential related-person transactions and to effectuate the terms of the policy. In addition, under our code of business conduct and ethics, our employees and directors will have an affirmative responsibility to disclose any transaction or relationship that reasonably could be expected to give rise to a conflict of interest. In considering related person transactions, our audit committee, or other independent body of our board of directors, will take into account the relevant available facts and circumstances including, but not limited to:

| ● | the risks, costs and benefits to us; |

| ● | the impact on a director’s independence in the event that the related person is a director, immediate family member of a director or an entity with which a director is affiliated; |

| ● | the availability of other sources for comparable services or products; and |

| ● | the terms available to or from, as the case may be, unrelated third parties or to or from employees generally. |

The policy requires that, in determining whether to approve, ratify or reject a related person transaction, our audit committee, or other independent body of our board of directors, must consider, in light of known circumstances, whether the transaction is in, or is not inconsistent with, our best interests and those of our shareholders, as our audit committee, or other independent body of our board of directors, determines in the good faith exercise of its discretion.

- 8 -

REVERSE STOCK SPLIT

Our board of directors has approved an amendment to our Certificate of Incorporation to combine the outstanding shares of our common stock into a lesser number of outstanding shares (a “Reverse Stock Split”). If approved by the stockholders as proposed, the board of directors would have the sole discretion to effect the Reverse Stock Split, if at all, within one (1) year of the date the proposal is approved by stockholders and to fix the specific ratio for the combination within a range of one-for-five (1-for-5) to a maximum of a one-for-fifty (1-for-50) split. The board of directors has the discretion to abandon the amendment and not implement the Reverse Stock Split. We believe that enabling the board of directors to fix the specific ratio of the Reverse Stock Split within the stated range will provide us with the flexibility to implement it in a manner designed to maximize the anticipated benefits for our stockholders.

In fixing the ratio, the board of directors may consider, among other things, factors such as: the initial and continued listing requirements of the Nasdaq Capital Market; the number of shares of our common stock outstanding; potential financing opportunities; and prevailing general market and economic conditions.

The Reverse Stock Split, if approved by our stockholders, would become effective upon the filing of the amendment to our certificate of incorporation with the Secretary of State of the State of Delaware, or at the later time set forth in the amendment. The exact timing of the amendment will be determined by the board of directors based on its evaluation as to when such action will be the most advantageous to our Company and our stockholders. In addition, the board of directors reserves the right, notwithstanding stockholder approval and without further action by the stockholders, to abandon the amendment and the Reverse Stock Split if, at any time prior to the effectiveness of the filing of the amendment with the Secretary of State of the State of Delaware, the board of directors, in its sole discretion, determines that it is no longer in our best interest and the best interests of our stockholders to proceed.

The proposed form of amendment to our certificate of incorporation to effect the Reverse Stock Split is attached as Appendix A to this Proxy Statement. Any amendment to our certificate of incorporation to effect the Reverse Stock Split will include the Reverse Stock Split ratio fixed by the board of directors, within the range approved by our stockholders.

Reasons for the Reverse Stock Split

The Company’s primary reasons for approving and recommending the Reverse Stock Split are to increase the per share price and bid price of our common stock to comply with the listing requirements of Nasdaq.

Reducing the number of outstanding shares of common stock should, absent other factors, generally increase the per share market price of the common stock. Although the intent of the Reverse Stock Split is to increase the price of the common stock, there can be no assurance, however, that even if the Reverse Stock Split is effected, that the bid price of the Company’s common stock will be sufficient, over time, for the Company to maintain compliance with the Nasdaq minimum bid price requirement.

Reducing the number of outstanding shares of our common stock through the Reverse Stock Split is intended, absent other factors, to increase the per share market price of our common stock. However, other factors, such as our financial results, market conditions and the market perception of our business may adversely affect the market price of our common stock. As a result, there can be no assurance that the Reverse Stock Split, if completed, will result in the intended benefits described above, that the market price of our common stock will increase following the Reverse Stock Split, that as a result of the Reverse Stock Split we will be able to meet or maintain a bid price over the minimum bid price requirement of Nasdaq or that the market price of our common stock will not decrease in the future. Additionally, we cannot assure you that the market price per share of our common stock after the Reverse Stock Split will increase in proportion to the reduction in the number of shares of our common stock outstanding before the Reverse Stock Split. Accordingly, the total market capitalization of our common stock after the Reverse Stock Split may be lower than the total market capitalization before the Reverse Stock Split.

- 9 -

Potential Effects of the Proposed Amendment

If our stockholders approve the Reverse Stock Split and the board of directors effects it, the number of shares of common stock issued and outstanding will be reduced, depending upon the ratio determined by the board of directors. The Reverse Stock Split will affect all holders of our common stock uniformly and will not affect any stockholder’s percentage ownership interest in the Company, except that as described below in “Fractional Shares,” record holders of common stock otherwise entitled to a fractional share as a result of the Reverse Stock Split because they hold a number of shares not evenly divisible by the Reverse Stock Split ratio will automatically be entitled to receive an additional fraction of a share of common stock to round up to the next whole share. In addition, the Reverse Stock Split will not affect any stockholder’s proportionate voting power (subject to the treatment of fractional shares).

The Reverse Stock Split will not change the terms of the common stock. Additionally, the Reverse Stock Split will have no effect on the number of common stock that we are authorized to issue. After the Reverse Stock Split, the shares of common stock will have the same voting rights and rights to dividends and distributions and will be identical in all other respects to the common stock now authorized. The common stock will remain fully paid and non-assessable.

After the effective time of the Reverse Stock Split, we will continue to be subject to the periodic reporting and other requirements of the Exchange Act.

Registered “Book-Entry” Holders of Common Stock and Series A Preferred Stock

Our registered holders of common stock hold some or all of their shares electronically in book-entry form with the transfer agent. Our registered holders of Series A preferred stock hold all of their shares electronically in book-entry form with the transfer agent. These stockholders do not have stock certificates evidencing their ownership. They are, however, provided with statements reflecting the number of shares registered in their accounts.

Stockholders who hold shares electronically in book-entry form with the transfer agent will not need to take action to receive evidence of their shares of post-Reverse Stock Split common stock.

Holders of Certificated Shares of Common Stock

Stockholders holding shares of our common stock in certificated form will be sent a transmittal letter by the transfer agent after the effective time of the Reverse Stock Split. The letter of transmittal will contain instructions on how a stockholder should surrender his, her or its certificate(s) representing shares of our common stock (the “Old Certificates”) to the transfer agent. Unless a stockholder specifically requests a new paper certificate or holds restricted shares, upon the stockholder’s surrender of all of the stockholder’s Old Certificates to the transfer agent, together with a properly completed and executed letter of transmittal, the transfer agent will register the appropriate number of shares of post-Reverse Stock Split common stock electronically in book-entry form and provide the stockholder with a statement reflecting the number of shares registered in the stockholder’s account. No stockholder will be required to pay a transfer or other fee to exchange his, her or its Old Certificates. Until surrendered, we will deem outstanding Old Certificates held by stockholders to be cancelled and only to represent the number of shares of post-Reverse Stock Split common stock to which these stockholders are entitled. Any Old Certificates submitted for exchange, whether because of a sale, transfer or other disposition of stock, will automatically be exchanged for appropriate number of shares of post-Reverse Stock Split common stock. If an Old Certificate has a restrictive legend on its reverse side, a new certificate will be issued with the same restrictive legend on its reverse side.

STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY STOCK CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Fractional Shares

We will not issue fractional shares in connection with the Reverse Stock Split. Instead, stockholders who otherwise would be entitled to receive fractional shares because they hold a number of shares not evenly divisible by the Reverse Stock Split ratio will automatically be entitled to receive an additional fraction of a share of common stock to round up to the next whole share. In any event, cash will not be paid for fractional shares.

- 10 -

Effect of the Reverse Stock Split on Outstanding Stock Options and Warrants

Based upon the Reverse Stock Split ratio, proportionate adjustments are generally required to be made to the per share exercise price and the number of shares issuable upon the exercise of all outstanding options and warrants. This would result in approximately the same aggregate price being required to be paid under such options or warrants upon exercise, and approximately the same value of shares of common stock being delivered upon such exercise immediately following the Reverse Stock Split as was the case immediately preceding the Reverse Stock Split. The number of shares reserved for issuance pursuant to these securities will be reduced proportionately based upon the Reverse Stock Split ratio.

Accounting Matters

The proposed amendment to our Certificate of Incorporation will not affect the par value of our common stock. As a result, at the effective time of the Reverse Stock Split, the stated capital on our balance sheet attributable to the common stock will be reduced in the same proportion as the Reverse Stock Split ratio, and the additional paid-in capital account will be credited with the amount by which the stated capital is reduced. The per share net income or loss will be restated for prior periods to conform to the post-Reverse Stock Split presentation.

Certain Federal Income Tax Consequences of the Reverse Stock Split

The following summary describes, as of the date of this proxy statement, certain U.S. federal income tax consequences of the Reverse Stock Split to holders of our common stock. This summary addresses the tax consequences only to a U.S. holder, which is a beneficial owner of our common stock that is either:

| ● | an individual citizen or resident of the United States; |

| ● | a corporation, or other entity taxable as a corporation for U.S. federal income tax purposes, created or organized in or under the laws of the United States or any state thereof or the District of Columbia; |

| ● | an estate, the income of which is subject to U.S. federal income taxation regardless of its source; or |

| ● | a trust, if: (i) a court within the United States is able to exercise primary jurisdiction over its administration and one or more U.S. persons has the authority to control all of its substantial decisions or (ii) it was in existence before August 20, 1996 and a valid election is in place under applicable Treasury regulations to treat such trust as a U.S. person for U.S. federal income tax purposes |

This summary is based on the provisions of the Internal Revenue Code of 1986, as amended (the “Code”), U.S. Treasury regulations, administrative rulings and judicial authority, all as in effect as of the date of this proxy statement. Subsequent developments in U.S. federal income tax law, including changes in law or differing interpretations, which may be applied retroactively, could have a material effect on the U.S. federal income tax consequences of the Reverse Stock Split.

This summary does not address all of the tax consequences that may be relevant to any particular investor, including tax considerations that arise from rules of general application to all taxpayers or to certain classes of taxpayers or that are generally assumed to be known by investors. This summary also does not address the tax consequences to (i) persons that may be subject to special treatment under U.S. federal income tax law, such as banks, insurance companies, thrift institutions, regulated investment companies, real estate investment trusts, tax-exempt organizations, U.S. expatriates, persons subject to the alternative minimum tax, persons whose functional currency is not the U.S. dollar, partnerships or other pass-through entities, traders in securities that elect to mark to market and dealers in securities or currencies, (ii) persons that hold our common stock as part of a position in a “straddle” or as part of a “hedging transaction,” “conversion transaction” or other integrated investment transaction for federal income tax purposes or (iii) persons that do not hold our common stock as “capital assets” (generally, property held for investment). This summary does not address backup withholding and information reporting. This summary does not address U.S. holders who beneficially own common stock through a “foreign financial institution” (as defined in Code Section 1471(d)(4)) or certain other non-U.S. entities specified in Code Section 1472. This summary does not address tax considerations arising under any state, local or foreign laws, or under federal estate or gift tax laws.

If a partnership (or other entity classified as a partnership for U.S. federal income tax purposes) is the beneficial owner of our common stock, the U.S. federal income tax treatment of a partner in the partnership will generally depend on the status of the partner and the activities of the partnership. Partnerships that hold our common stock, and partners in such partnerships, should consult their own tax advisors regarding the U.S. federal income tax consequences of the Reverse Stock Split.

- 11 -

Each holder should consult his, her or its own tax advisors concerning the particular U.S. federal tax consequences of the Reverse Stock Split, as well as the consequences arising under the laws of any other taxing jurisdiction, including any foreign, state, or local income tax consequences.

General Tax Treatment of the Reverse Stock Split

The Reverse Stock Split is intended to qualify as a “reorganization” under Section 368 of the Code that should constitute a “recapitalization” for U.S. federal income tax purposes. Assuming the Reverse Stock Split qualifies as a reorganization, a U.S. holder generally will not recognize gain or loss upon the exchange of our ordinary shares for a lesser number of ordinary shares, based upon the Reverse Stock Split ratio. A U.S. holder’s aggregate tax basis in the lesser number of ordinary shares received in the Reverse Stock Split will be the same such U.S. holder’s aggregate tax basis in the shares of our common stock that such U.S. holder owned immediately prior to the Reverse Stock Split. The holding period for the ordinary shares received in the Reverse Stock Split will include the period during which a U.S. holder held the shares of our common stock that were surrendered in the Reverse Stock Split. The United States Treasury regulations provide detailed rules for allocating the tax basis and holding period of the shares of our common stock surrendered to the shares of our common stock received pursuant to the Reverse Stock Split. U.S. holders of shares of our common stock acquired on different dates and at different prices should consult their tax advisors regarding the allocation of the tax basis and holding period of such shares.

THE FOREGOING IS INTENDED ONLY AS A SUMMARY OF CERTAIN FEDERAL INCOME TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT, AND DOES NOT CONSTITUTE A TAX OPINION. EACH HOLDER OF OUR COMMON SHARES SHOULD CONSULT ITS OWN TAX ADVISOR REGARDING THE TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT TO THEM AND FOR REFERENCE TO APPLICABLE PROVISIONS OF THE CODE.

Interests of Executive Officers and Directors in this Proposal

Our executive officers, directors and director nominees, and associates of our executive officers, directors and director nominees do not have any substantial interest, direct or indirect, in this proposal.

Required Vote of Stockholders

The affirmative vote of the holders of a majority of voting power the outstanding shares of our common stock and Series A preferred stock is required to approve this proposal.

Board Recommendation

The board of directors unanimously recommends a vote “FOR” the grant to the board of discretionary authority to (i) amend our certificate of incorporation to combine outstanding shares of our common stock into a lesser number of outstanding shares, or a “reverse stock split,” at a specific ratio within a range of one-for-five (1-for-five) to a maximum of a one-for-fifty (1-for-fifty) split, with the exact ratio to be determined by our board of directors in its sole discretion; and (ii) effect the reverse stock split, if at all, within one year of the date the proposal is approved by stockholders.

- 12 -

APPROVAL OF AN AMENDMENT TO THE 2018 EQUITY INCENTIVE PLAN

Summary

On January 12, 2023, our board of directors approved an amendment to the Company’s 2018 Equity Incentive Plan (the “2018 Plan”) to increase the number of shares available for issuance under the 2018 Plan by 3,000,000 shares and (ii) increase the amount of shares that may be issued pursuant to the exercise of incentive stock options by 3,000,000 shares. The proposed form of amendment to our 2018 Plan is attached as Appendix B to this Proxy Statement.

The amendment to the 2018 Plan is intended to ensure that the Company can continue to provide an incentive to employees, directors and consultants by enabling them to share in the Company’s future growth. If approved by the stockholders, all of the additional shares will be available for grant as incentive stock options within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended (the “Code”), or as nonqualified stock options, restricted stock awards, stock appreciation rights, or other kinds of equity based compensation available under the 2018 Plan. If the stockholders do not approve the amendment, no shares will be added to the number of shares available for issuance under the 2018 Plan.

Background

On April 26, 2018, Amesite Parent’s board of directors adopted, and Amesite Parent’s stockholders approved, the 2018 Plan. The 2018 Plan is intended to align the interests stockholders and the recipients of awards under the 2018 Plan, and to advance Amesite Parent’s interests by attracting and retaining directors, officers, employees and other service providers and motivating them to act in our long-term best interests. The material terms of the 2018 Plan are set forth below:

Summary of Key Terms of the Plan

Plan term. The 2018 Plan became effective on July 23, 2018 and terminates on the tenth anniversary of its effective date, unless terminated earlier by Amesite Parent’s board of directors.

Eligible participants. All officers, directors, employees, consultants, agents and independent contractors, and persons expected to become officers, directors, employees, consultants, agents and independent contractors of Amesite Parent or any of its subsidiaries are eligible to receive awards under the 2018 Plan. The Compensation Committee of Amesite Parent’s board of directors determines the participants under the 2018 Plan.

Shares authorized. 2,529,000 shares of common stock were initially available for awards granted under the 2018 Plan, inclusive of 1,288,195 shares subject to options originally granted under the 2017 Plan and assumed in connection with the Merger, subject to adjustment for stock splits and other similar changes in capitalization. The number of available shares will be reduced by the aggregate number of shares that become subject to outstanding awards granted under the 2018 Plan. As of the first day of each calendar year beginning on or after January 1, 2021, the number of shares available for all awards under the 2018 Plan, other than incentive stock options, will automatically increase by a number equal to the least of (i) five percent (5%) of the number of shares of the Company’s common stock that are issued and outstanding as of that date, or (ii) a lesser number of shares of the Company’s common stock as determined by the Compensation Committee. To the extent that shares of common stock subject to an outstanding award granted under the 2018 Plan are not issued or delivered by reason of the expiration, termination, cancellation or forfeiture of such award (excluding shares of common stock subject to an option cancelled upon settlement in shares of common stock of a related tandem share appreciation right or shares of common stock subject to a tandem share appreciation right cancelled upon exercise of a related option) or by reason of the settlement of an award in cash, then those shares of common stock will again be available under the 2018 Plan, other than for grants of incentive stock options. In addition, any shares covered by an award that have been surrendered in connection with the payment of the award exercise or purchase price or in satisfaction of tax withholding obligations incident to the grant, exercise, vesting or settlement of an award will be deemed not to have been issued for purposes of determining the maximum number of shares of common stock which may be issued pursuant to all awards under the 2018 Plan. Effective August 4, 2020, upon approval of the stockholders of Amesite Parent, the total number of shares of common stock issuable under the 2018 Plan was increased to 4,600,000 shares. If the amendment to the 2018 Plan is approved, the total number of shares of common stock issuable under the 2018 Plan would be 7,600,000.

Award types. Awards include non-qualified and incentive stock options, stock appreciation rights, bonus shares, restricted shares, restricted share units, performance units and cash-based awards.

- 13 -

Administration. The Compensation Committee of Amesite Parent administers the 2018 Plan. The Compensation Committee’s interpretation, construction and administration of the 2018 Plan and all of its determinations thereunder is conclusive and binding on all persons.

The Compensation Committee has the authority to determine the participants in the 2018 Plan, the form, amount and timing of any awards, the performance goals, if any, and all other terms and conditions pertaining to any award. The Compensation Committee may take any action such that (i) any outstanding options and stock appreciation rights become exercisable in part or in full, (ii) all or any portion of a restriction period on any restricted share or restricted share units will lapse, (iii) all or a portion of any performance period applicable to any performance-based award will lapse, and (iv) any performance measures applicable to any outstanding award will be deemed satisfied at the target level or any other level. Subject to the terms of the 2018 Plan relating to grants to our executive officers and directors, the Compensation Committee may delegate some or all of its powers and authority to the Chief Executive Officer and President or other executive officer as the Compensation Committee deems appropriate.

Stock options and stock appreciation rights. The 2018 Plan provides for the grant of stock options and share appreciation rights. Stock options may be either tax-qualified incentive stock options or non-qualified stock options. The Compensation Committee will determine the terms and conditions to the exercisability of each option and share appreciation right.

The period for the exercise of a non-qualified stock option or stock appreciation right will be determined by the Compensation Committee provided that no option may be exercised later than ten years after its date of grant. The exercise price of a non-qualified stock option and the base price of a stock appreciation right will not be less than 100% of the fair market value of a share of our common stock on the date of grant, provided that the base price of a share appreciation right granted in tandem with an option will be the exercise price of the related option. A stock appreciation right entitles the holder to receive upon exercise, subject to tax withholding in respect of an employee, shares of our common stock, which may be restricted stock, with a value equal to the difference between the fair market value of our common stock on the exercise date and the base price of the share appreciation right.

Each incentive stock option will be exercisable for not more than 10 years after its date of grant, unless the optionee owns greater than 10% of the voting power of all shares of our capital stock, or a “ten percent holder,” in which case the option will be exercisable for not more than five years after its date of grant. The exercise price of an incentive stock option will not be less than the fair market value of a share of our common stock on its date of grant, unless the optionee is a ten percent holder, in which case the option exercise price will be the price required by the Code, currently 110% of fair market value.

Upon exercise, the option exercise price may be paid in cash, by the delivery of previously owned shares of our common stock, share withholding or through a cashless exercise arrangement, as permitted by the applicable award agreement. All of the terms relating to the exercise, cancellation or other disposition of an option or stock appreciation right upon a termination of employment, whether by reason of disability, retirement, death or any other reason, will be determined by the Compensation Committee.

The Compensation Committee, without stockholder approval, may (i) reduce the exercise price of any previously granted option or the base appreciation amount of any previously granted stock appreciation right, or (ii) cancel any previously granted option or stock appreciation right at a time when its exercise price or base appreciation amount (as applicable) exceeds the fair market value of the underlying shares, in exchange for another option, stock appreciation right or other award or for cash.

Stock awards. The 2018 Plan provides for the grant of share awards. The Compensation Committee may grant a share award as a bonus stock award, a restricted share award or a restricted share unit award and, in the case of a restricted share award or restricted share unit award, the Compensation Committee may determine that such award will be subject to the attainment of performance measures over an established performance period. All of the terms relating to the satisfaction of performance measures and the termination of a restriction period, or the forfeiture and cancellation of a stock award upon a termination of employment, whether by reason of disability, retirement, death or any other reason, will be determined by the Compensation Committee.

- 14 -

The agreement awarding restricted share units will specify whether such award may be settled in shares of our common stock, cash or a combination thereof and whether the holder will be entitled to receive dividend equivalents, on a current or deferred basis, with respect to such award. Prior to settlement of a restricted share unit in shares of our common stock, the holder of a restricted share unit will have no rights as our stockholder.

Unless otherwise set forth in a restricted stock award agreement, the holder of shares of restricted stock will have rights as our stockholder, including the right to vote and receive dividends with respect to the shares of restricted stock, except that distributions other than regular cash dividends and regular cash dividends with respect to shares of restricted stock subject to performance-based vesting conditions will be held by us and will be subject to the same restrictions as the restricted shares.

Performance unit awards. The 2018 Plan provides for the grant of performance unit awards. Each performance unit is a right, contingent upon the attainment of performance measures within a specified performance period, to receive a specified cash amount, shares of our common stock or a combination thereof which may be restricted stock, having a fair market value equal to such cash amount. Prior to the settlement of a performance unit award in shares of our common stock, the holder of such award will have no rights as our stockholder with respect to such shares. Performance units will be non-transferable and subject to forfeiture if the specified performance measures are not attained during the specified performance period. All of the terms relating to the satisfaction of performance measures and the termination of a performance period, or the forfeiture and cancellation of a performance unit award upon a termination of employment, whether by reason of disability, retirement, death or any other reason, will be determined by the Compensation Committee.

Cash-based awards. The 2018 Plan also provides for the grant of cash-based awards. Each cash-based award is an award denominated in cash that may be settled in cash and/or shares, which may be subject to restrictions, as established by the Compensation Committee.

Performance goals. Under the 2018 Plan, the vesting or payment of performance-based awards will be subject to the satisfaction of certain performance goals. The performance goals applicable to a particular award will be determined by the Compensation Committee at the time of grant. The performance goals may be one or more of the following corporate-wide or subsidiary, division, operating unit or individual measures, stated in either absolute terms or relative terms.

Individual Limits. With respect to non-employee directors, the maximum grant date fair value of shares that may be granted to an individual non-employee director during any fiscal year of Amesite Parent or its subsidiaries is $150,000. In connection with a non-employee director’s commencement of service with the Company, the per person limit set forth in the previous sentence will be $150,000.

Amendment or termination of the 2018 Plan. Amesite Parent’s board of directors may amend or terminate the 2018 Plan as it deems advisable, subject to any requirement of stockholder approval required by law, rule or regulation; provided, however, that no such amendment may materially impair the rights of a holder of an outstanding award without the consent of such holder.

Change of control. In the event of a change of control, Amesite Parent’s board of directors may, in its discretion, (1) provide that (A) some or all outstanding options and share appreciation rights will immediately become exercisable in full or in part, (B) the restriction period applicable to some or all outstanding stock awards will lapse in full or in part, (C) the performance period applicable to some or all outstanding awards will lapse in full or in part, and (D) the performance measures applicable to some or all outstanding awards will be deemed to be satisfied at the target or any other level, (2) provide that some or all outstanding awards will terminate without consideration as of the date of the change of control, (3) require that shares of stock of the corporation resulting from such change of control, or a parent corporation thereof, be substituted for some or all of our shares subject to an outstanding award, and/or (4) require outstanding awards, in whole or in part, to be surrendered by the holder, and to be immediately cancelled, and to provide for the holder to receive (A) a cash payment in an amount equal to (i) in the case of an option or share appreciation right, the number of our shares then subject to the portion of such option or share appreciation right surrendered, whether vested or unvested, multiplied by the excess, if any, of the fair market value of a share of our common stock as of the date of the change of control, over the purchase price or base price per share of our common stock subject to such option or stock appreciation right, (ii) in the case of a stock award, the number of shares of our common stock then subject to the portion of such award surrendered, whether vested or unvested, multiplied by the fair market value of a share of our common stock as of the date of the change of control, and (iii) in the case of a performance unit award, the value of the performance units then subject to the portion of such award surrendered; (B) shares of capital stock of the corporation resulting from such change of control, or a parent corporation thereof, having a fair market value not less than the amount determined under clause (A) above; or (C) a combination of the payment of cash pursuant to clause (A) above and the issuance of shares pursuant to clause (B) above.

- 15 -

Under the 2018 Plan, a change of control will occur upon: (i) a person’s or entity’s acquisition, other than from Amesite Parent, of beneficial ownership of 50% or more of either our then outstanding shares or the combined voting power of our then outstanding voting securities, but excluding certain acquisitions by the company, its subsidiaries or employee benefit plans, or by a corporation in which our stockholders hold a majority interest; (ii) a reorganization, merger or consolidation of the company if our stockholders do not thereafter beneficially own more than 50% of the outstanding shares or combined voting power of the resulting company, (iii) certain changes to the incumbent directors of our Company, or (iv) a complete liquidation or dissolution of the company or of the sale or other disposition of all or substantially all of our assets; but excluding, in any case, the initial public offering or any bona fide primary or secondary public offering following the occurrence of the initial public offering.

US Federal Income Tax Consequences. The following is a summary of certain United States federal income tax consequences of awards under the 2018 Plan. It does not purport to be a complete description of all applicable rules, and those rules (including those summarized here) are subject to change.

Non-Qualified Stock Options. A participant who has been granted a non-qualified stock option will not recognize taxable income upon the grant of a non-qualified stock option. Rather, at the time of exercise of such non-qualified stock option, the participant will recognize ordinary income for income tax purposes in an amount equal to the excess of the fair market value of the shares of common stock purchased over the exercise price. We generally will be entitled to a tax deduction at such time and in the same amount that the participant recognizes ordinary income. If shares of common stock acquired upon exercise of a non-qualified stock option are later sold or exchanged, then the difference between the amount received upon such sale or exchange and the fair market value of such shares on the date of such exercise will generally be taxable as long-term or short-term capital gain or loss (if the shares are a capital asset of the participant) depending upon the length of time such shares were held by the participant.

Incentive Stock Options. In general, no taxable income is realized by a participant upon the grant of an ISO. If shares of common stock are purchased by a participant, or option shares, pursuant to the exercise of an ISO granted under the 2018 Plan and the participant does not dispose of the option shares within the two-year period after the date of grant or within one year after the receipt of such option shares by the participant, such disposition a disqualifying disposition, then, generally (1) the participant will not realize ordinary income upon exercise and (2) upon sale of such option shares, any amount realized in excess of the exercise price paid for the option shares will be taxed to such participant as capital gain (or loss). The amount by which the fair market value of the common stock on the exercise date of an ISO exceeds the purchase price generally will constitute an item which increases the participant’s “alternative minimum taxable income.” If option shares acquired upon the exercise of an ISO are disposed of in a disqualifying disposition, the participant generally would include in ordinary income in the year of disposition an amount equal to the excess of the fair market value of the option shares at the time of exercise (or, if less, the amount realized on the disposition of the option shares), over the exercise price paid for the option shares. Subject to certain exceptions, an option generally will not be treated as an ISO if it is exercised more than three months following termination of employment. If an ISO is exercised at a time when it no longer qualifies as an ISO, such option will be treated as a nonqualified stock option as discussed above. In general, we will receive an income tax deduction at the same time and in the same amount as the participant recognizes ordinary income.

Stock Appreciation Rights. A participant who is granted an SAR generally will not recognize ordinary income upon receipt of the SAR. Rather, at the time of exercise of such SAR, the participant will recognize ordinary income for income tax purposes in an amount equal to the value of any cash received and the fair market value on the date of exercise of any shares of common stock received. We generally will be entitled to a tax deduction at such time and in the same amount, if any, that the participant recognizes as ordinary income. The participant’s tax basis in any shares of common stock received upon exercise of an SAR will be the fair market value of the shares of common stock on the date of exercise, and if the shares are later sold or exchanged, then the difference between the amount received upon such sale or exchange and the fair market value of such shares on the date of exercise will generally be taxable as long-term or short-term capital gain or loss (if the shares are a capital asset of the participant) depending upon the length of time such shares were held by the participant.